Does the Balance Sheet Always Balance?

Both liabilities and shareholders’ equity represent how the assets of a company are financed. If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity. Changes in balance sheet accounts are also used to calculate cash flow in the cash flow statement. For example, a positive change in plant, property, and equipment is equal to capital expenditure minus depreciation expense.

- 11 Financial is a registered investment adviser located in Lufkin, Texas.

- The cash flow statement is generated in bookkeeping from information on the balance sheet.

- As transactions occur within a business, the amounts of assets, liabilities, and owner’s equity change.

- $30,000 is credited to cash, and $30,000 is debited to inventory.

- The term capital includes the capital introduced by the business owner plus or minus any profits or losses made by the business.

Importance of a Balance Sheet

Please see Robinhood Financial’s Fee Schedule to learn more regarding brokerage transactions. Please see Robinhood Derivative’s Fee Schedule to learn more about commissions on futures transactions. At the bottom of the balance sheet, we can see that total liabilities and 21 expert tips to take your business to the next level shareholders’ equity are added together to come up with $375,319 billion which balances with Apple’s total assets. The cash (asset) of the business will increase by $5,000 as will the amount representing the investment from Anushka as the owner of the business (capital).

Ask Any Financial Question

Analyze a company’s financial records as an analyst on a technology team in this free job simulation. Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Shareholders’ Equity

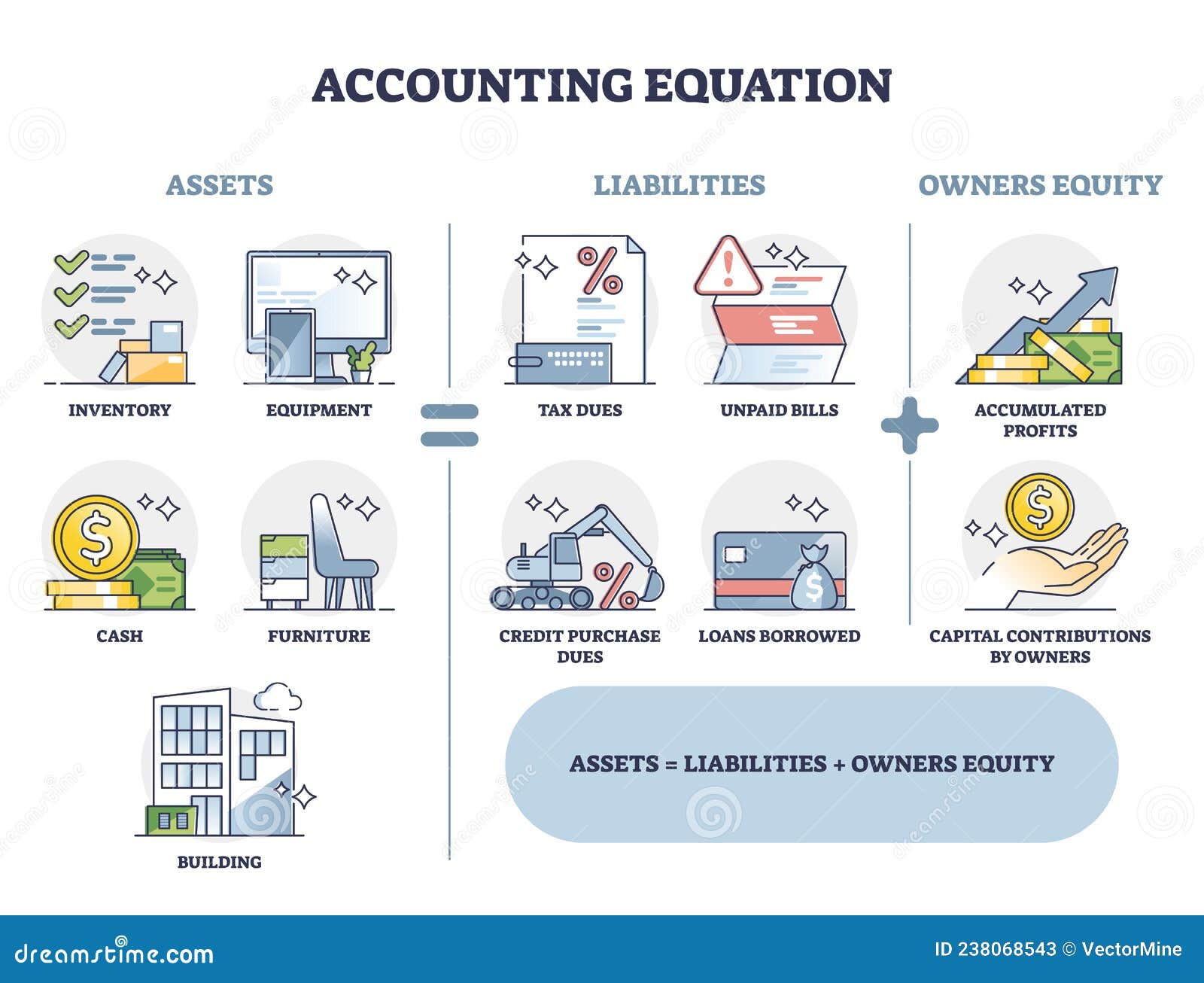

The balance sheet formula remains constant, reflecting the accounting equation that assets must always equal the sum of liabilities and shareholders’ equity. However, the values of individual items within the formula can change as a company’s financial position evolves. If a company keeps accurate records using the double-entry system, the accounting equation will always be “in balance,” meaning the left side of the equation will be equal to the right side. The balance is maintained because every business transaction affects at least two of a company’s accounts. For example, when a company borrows money from a bank, the company’s assets will increase and its liabilities will increase by the same amount.

Examples of assets include cash, accounts receivable, inventory, prepaid insurance, investments, land, buildings, equipment, and goodwill. From the accounting equation, we see that the amount of assets must equal the combined amount of liabilities plus owner’s (or stockholders’) equity. The assets on the balance sheet consist of what a company owns or will receive in the future and which are measurable.

What Is the Balance Sheet Formula?

If a business buys raw materials and pays in cash, it will result in an increase in the company’s inventory (an asset) while reducing cash capital (another asset). Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting. Balance sheets, like all financial statements, will have minor differences between organizations and industries. However, there are several “buckets” and line items that are almost always included in common balance sheets.

A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. Current liabilities are due within one year and are listed in order of their due date. Long-term liabilities, on the other hand, are due at any point after one year.

Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business owners. Incorrect classification of an expense does not affect the accounting equation. The major and often largest value assets of most companies are that company’s machinery, buildings, and property.