Just what are Decentralised Crypto Exchanges? DEX Said

Harmony is available to when they features an excellent supported bag strung. Even in the first development stages, decentralized crypto exchanges provide professionals one impact digital investment custody and you may range, transactional trust, change costs, and you may investor confidentiality. A DEX that’s a keen aggregator for the best change cost amongst over 200 exchangeability supply and you can enhance exchanges to have profiles is often described as the best DEX aggregator. 1inch Exchange assists buyers go prices-effective exchange at best cost and with the extreme slippage.

“They promise rate and you may privacy, however, profiles get confronted with more regulating or functional risks later down the line,” Puckrin said. DEX front ends and you may aggregators get face laws once they be considered as the services. During the early 2025, accounts told you the brand new SEC finalized one analysis rather than step. That it lead does not lay formal plan, but it things to developers and you can profiles. Private trick theft and you can front side-prevent hijacks drove really losses at the beginning of 2025.

- This type of swimming pools are made when pages put their crypto for the a good common pool, and you will positions are made based on a formula you to set the newest rate.

- And no cellular phone-dependent recovery, time-locked international settings, and you can real-time risk overseeing, it’s built to protect your possessions at each covering.

- In order to decrease process chance, you should always usually unplug their wallet of a good DEX when you are maybe not actively trade.

- One talked about enterprise leveraging Polygon is the Clear Token (SHARP), the new local token of one’s Clear Economy.

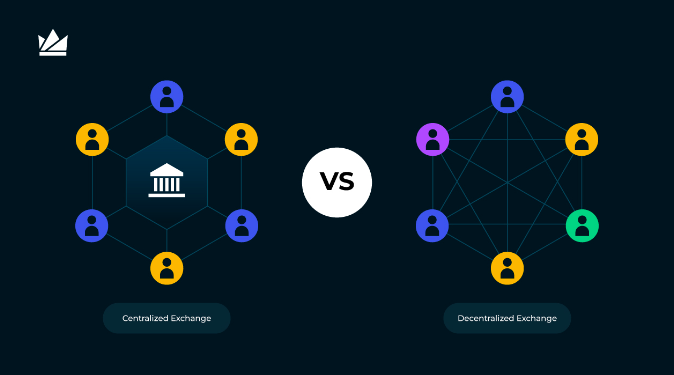

In a really decentralized replace, there’s no star on the other prevent. The new developers who developed the process wear’t have the same relationship with profiles. While you are you will find whole groups out of DEX pages, you’lso are guilty of the currency. You could potentially mint an alternative token and begin exchanging it to possess a pal’s token instantly. Such as this, DEXs enable it to be people to very own tokens to use within the decentralized financing (DeFi), characteristics that enable them to help save, use, provide, or trading instead of dealing with a bank and other lender.

Centrifuge Launches Tokenized S&P five hundred Index Money on the Coinbase’s Ft Community | hyperliquid exchange

Decentralized transfers is actually compatible with non-custodial digital purses, helping users to get in touch a wallet to have exchange when you’re preserving complete sovereignty across the handbag and its own possessions. DEX pages wear’t have to trust your replace usually responsibly create its digital holdings. That’s a huge manifestation of how quickly everything is altering inside the the brand new crypto world. Decentralized exchanges know moving on industry character from the to play a good grand part in the DeFi environment. These types of transfers have to give buyers a customized, novel, and you can safe change experience. Far more than just half the brand new crypto trade inhabitants prefers to trade-in Decentralized transfers.

WannaCry ransomwarecrypto-worm assault

Which produces “impermanent losses.” If a person token moves much, the fresh pool ends up with additional of one’s weaker token. In the August 2025, DEXs handled from the $step 1.15 trillion whenever merging place and you can decentralized hyperliquid exchange perps. These rates draw for the DeFiLlama research advertised because of the legitimate industry media. Hyperliquid held nearly 73% of your own perpetual DEX business that have $898 billion in the derivatives/perpetuals exchange regularity during the Q2 2025.

The brand new built-in distribution in the blockchains produces him or her especially really-fitted to inter-organizational elizabeth-Team software (Lokshina, 2022). By cryptographically promoting blocks homes transactions, blockchains expose an immutable listing. Inside a distributed blockchain, players do an equal-to-peer (P2P) circle to autonomously make certain transactions and add them to the blockchain. Relating to inter-organizational workflow administration, consensus among people try pivotal to decide works status, influencing the new assortment of subsequent legitimate steps in the process. The chance of blockchain technology from the finance business is higher and widely recognized (Peters & Panayi, 2016).

These types of swimming pools are funded from the liquidity team which deposit equivalent philosophy out of two some other cryptocurrencies, providing profiles in order to trading contrary to the pond. The purchase price is dynamically modified according to the likewise have and you may consult within the pool, ultimately causing a constant speed contour. Blockchain technical has tall potential to address a number of the trick pressures in the field of larger study. Because of the leverage blockchain’s decentralized and you will safe nature, a data-discussing platform is going to be centered which allows the brand new effective and safe change of data certainly all the inside it parties (Chen & Xue, 2017).

Typically, builders tried to make decentralized exchanges (DEXs), however these effort have been mostly unproductive. An element of the issue with DEXs in the past is the necessity for a lot more exchangeability. Decentralized transfers have additional shapes and forms, for each built to helps trading rather than counting on intermediaries. When you’re all DEXs try to provide immediate access to help you crypto segments, they use other mechanisms to help you techniques deals, do assets, and you can support DEX pages. AirSwap also offers a distinctive decentralized change feel, centering on peer-to-fellow token exchanges inside Ethereum ecosystem.

The brand new assailant hits it by propagating the knowledge packets because of devices, which results in a lot of waits and certainly will avoid the blockchain of functioning properly (Zhong & Guo, 2021). Such attack will be such hazardous in the genuine-day blockchain possibilities, in which timing is essential so that the right doing work of your circle. Concurrently, implementing safe date synchronization standards may also be helpful prevent slow down symptoms. They will opponent dependent perp DEXes by offering superior UX, and mobile software to have ios and android, and you will intent-based systems to possess automatic performance. ASTER ($ASTER) ‘s the core token of one’s Aster ecosystem, a good decentralized exchange worried about perpetual deals and you will spot trading. It came up regarding the merger away from Astherus, known for produce items like liquid-bet BNB (asBNB) and give-results stablecoin USDF, and you will APX Money, a powerful perp change program.

Moreover, the brand new proof functions used in Bitcoin is additionally centered on the brand new SHA256 setting (Ye et al., 2018). And anyone navigating it a mess, products including Best Purse provide a way to cut the newest noise. It claimed’t stop regulators out of cracking off, nonetheless it helps you change wiser, dodge cons and sustain their portfolio in check if the hype gets control of. In the first 50 percent of 2025, criminals stole more than $dos.47 billion around the cheats and you may scams.

Blockchain-Based Carbon dioxide Loans: The fresh Devices for Sustainability within the 2025

In principle, DEXs attempt to render options in order to centralized transfers, in behavior, they embody the pros and you can drawbacks of each form of change. A central exchange (CEX) are controlled by one classification otherwise organization, including an in person held business or in public areas replaced company. The new handling organization is completely accountable for every aspect of the platform’s company. As the decentralized programs, DEXs don’t generally assemble associate guidance which don’t in person are accountable to taxation bodies for instance the Internal revenue service. Simple fact is that affiliate’s duty to help you declaration and pay fees to the one deals as the required by their regional legislation. You will come across network charges, which happen to be paid back to help you blockchain miners or validators in order to procedure your transactions.

The following is a list of a number of the high have you to definitely perform determine the newest operational performance of your Decentralized Change Platforms. Set up a wallet for example MetaMask or Faith Wallet and you may secure the recuperation terms. Cryptocurrency change is highly unstable and not right for the investors. Excite make sure you completely understand the dangers inside it just before change. All of our platform produces commissions because of partnerships and sponsors, which is how exactly we assistance all of our experts.

Types of zero-KYC transfers in the 2025 tend to be MEXC, Margex, dYdX, Uniswap, PancakeSwap and Bisq. Most are centralized gowns such MEXC, CoinEx and you can PrimeXBT, where unproven users can invariably exchange, often with restrictions. By the end, a user can be trading on the a Decentralized Replace (DEX) with full confidence. Networks for example Uniswap to your Polygon try driving the newest limits away from speed, cost-performance, and around the world availability. And you will tokens including Clear Token (SHARP) are strengthening entire digital economies moreover base—rewarding profiles to possess studying, contributing, and you may broadening.